Tesla 1

Tiny Canadian Battery Company Could Play David to Goliath Tesla

Tesla Motors Inc., Panasonic Corp. and Samsung Electronics Co. are the giants who are battling it out in the race of mass producing large-scale rechargeable batteries. However, a tiny company may have hit the jackpot: Electrovaya Inc.

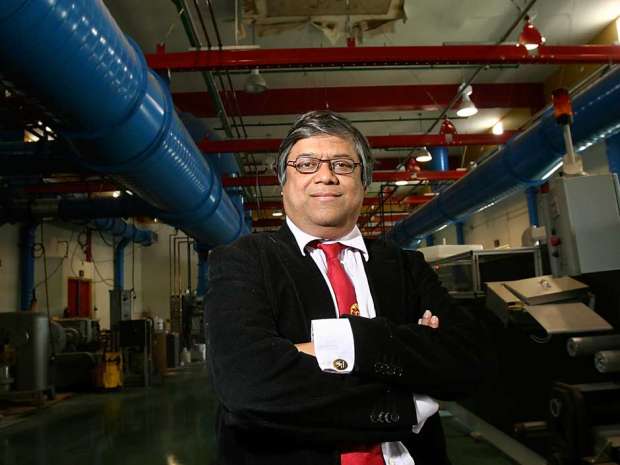

This Canadian company primarily manufactures lithium-ion batteries. It is owned and operated by an adjunct professor of electrochemistry at the University of Toronto. While the company’s portfolio might not seem impressive at first glance, investors are lining up at the door with Bloomberg New Energy Finance claiming its valuation at $250 billion by 2040.

Electrovaya’s shares have risen to five times their market value of C$297 million ($228.78 million) over the past 12 months. On the other hand, Tesla’s Powerwall failed to perform and they came down by 20%.

The company has risen at lightning speed, signing several deals worth millions of dollars. Electrovaya’s technology has 400 patents to its name and that is what gives the company its edge claims CEO Sankar Das Gupta. Not only is its flexible ceramic separator highly heat resistant, the company’s production processes are solvent-free which makes them greener for the environment and gives batteries double the life of a conventional one.

Indeed, the CEO claims to want to be the next General Electric. The small firm is taking on goliaths like Panasonic and Tesla, who are involved in joint product development. These two companies are involved in creating a $5 billion lithium-ion gigafactory in Nevada.

To finance their venture, the Canadian company has found some innovative solutions. It bought out Daimler AG’s lithium-ion battery manufacturing plant which was the largest in Europe. However, after the automaker decided to relinquish the business Electrovaya bought it at a fraction of its actual value.

This deal was also of utmost important due to the fact that it consisted of the factory’s proprietary ceramic separator technology. As the bane of a lithium-ion batteries is fire, the company seems to have made a strategic decision at the right time.

CEO Das Gupta claimed that the combination of German and Electrovaya technology will put them way ahead of Panasonic and Samsung. Today, the only competitor he sees is Polypore International Inc.’s lithium-ion separator. This company was acquired by Japan’s Asahi Kasei Corp. for $3.2 billion last year.

Beign a small company, Das Gupta says that the only problems he encounters is working capital. He hopes that the backing of Export Development Canada will help with the guarantee for lenders. While the company is the best bet in the energy equipment today, there’s no saying where the energy-storage marketplace tomorrow.