The Lowdown on Foreign Investment in Latin America

America hit a record low last year as Latin American economies saw a downturn for the first time in five years. Foreign investment in the mineral-rich region dropped by 19% reported the UN Economic Commission for Latin America and the Caribbean. This is the lowest figures since 2010.

This is being attributed to the sagging investment in sectors like mining, fossil fuels, etc. and the slowing down of the economy in general, particularly in Brazil. While mining nations like Chile and Peru fell prey to the slowdown, investments in Mexico saw an upsurge specifically in the auto and telecom sectors. On the plus side, these are more likely to prove to be beneficial to the broader economy in terms of technology, education, and indirect job creation.

Brazil has been worst hit, suffering a meltdown for the first time in decades. Its economy has shrunken by 3.8% since last year. News does not seem too good for Chile either, with experts forecasting that the country’s foreign investments would go further downward by 8% by next year.

Due to the sluggish global economy, the entire region is projected to go down by 0.6% this year. While the entire world was speculating of Chinese interest in the Latin American region, real figures are far smaller than the Netherlands (20 percent), the United States (17 percent), and Spain (10 percent). Asian FDI equals a mere 6 percent even with Chinese firms bagging three of the top 20 deals in 2014.

While Latin American countries could definitely do with the finance for transport infrastructure, telecommunications, and electricity, they have to bank on FDI in the face of low regional savings. The substantial foreign owned capital stock has gone up to over $100 billion today. Multinationals usually send home roughly half of these profits, and the rest is put into the local economy. This has become a huge financial burden for countries like Chile, Colombia, and Peru, among others, and possibly devalued their currencies, particularly if the investments don’t put back much in terms of productivity and economic growth.

Google to Train 1 Million Africans for Job Readiness

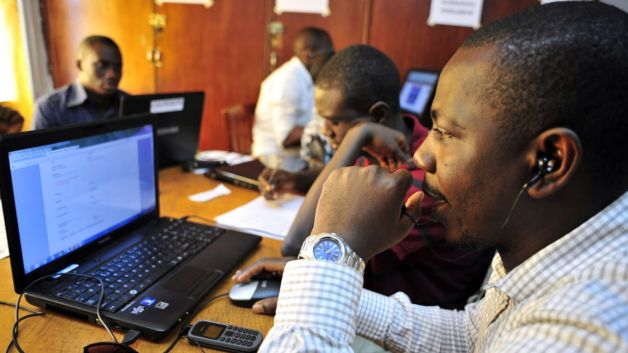

Google Inc. is working on a project to start a series of digital skills training programs in the next year. These programs are aimed at skilling Africans who are suffering due to a slow global economy, with unemployment being rife.

The company is slated to train 300,000 people in South Africa, where the majority of millennials (up to 35%) are unemployed. 600,000 youth from emerging nations like Kenya and Nigeria will be given digital training at no cost, while another 100,000 will be chosen from other sub-Saharan Africa countries.

Google South Africa country head Luke Mckend said, “Google is in Africa for the long haul and we are making an investment in talent. We hope that the people trained will become pioneers in the field and do great things in digital for companies and for Google.”

He also said that this was only the first step in progress and to see Africa conquer the digital world much more needed to be done. He went on to say that the Internet is a great tool for starting new businesses and growing exiting ones, and Google is dedicated to its mission in helping Africa’s emerging markets maximize on the digital revolution.

To accomplish its goal, google has tied up with Livity Africa to create training programs and will soon be setting up an online education website for learners in the African nations. The company is also in talks with several other potential partners across the continent to expand the outreach of the digital skills program and be able to get to even more young learners across Africa.

A TeleGeography Global Internet Geography report has claimed that the internet bandwidth in Africa has gone up 41% between 2014 and 2015. Google has investigated the possibility of Africa having 500 million Internet users by 2020. This is a useful piece of data for the company as it can leverage the Internet users to create a strong workforce for the economy.

Boeing to Develop New Mid-Size Plane Designs

Boeing Co. has seen a market for its first passenger jet since the 787 Dreamliner. The American airplane-making company is considering designs for mid-range planes which will carry travellers from New York to London and Sydney to Shanghai.

Their new aircraft is the middle child in its product offerings between the biggest single-aisle 737 and smallest widebody 787. This is a largely untouched market where Airbus Group SE is just starting to regard with potential.

Boeing has predicted sales of these mid-sized jets between 4,000 and 5,000 as airlines will set new routes for these planes. While the U.S. plane manufacturer is excited about outing plans to action, it does need to focus on a reasonable price point by closely monitoring production costs.

Mike Delaney, general manager of airplane development at Boeing felt confident in the success launch of these planes, saying that the planes would be ready for the commercial market by the next decade. Research conducted across 36 airline clients has boosted Delaney’s confidence in the product success, after years searching for something to replace the 757 which has fallen out of production.

The head of product development Mike Sinnett has started to get a feel for the numbers that airline companies will be willing to pay for the performance benefits they would expect for airplanes with a capacity between 200 and 270 people, and a range of flight around 5,000 nautical miles.

While Boeing is taking things slow and steady, the business end does seem like a challenge. Industry specialists have estimated demand at an orthodox figure of just 1,500 planes. If Boeing is to develop a design from scratch the costs they would incur would be in the ballpark of $10 billion. Also, this time let’s hope that Boeing has learnt from its mistakes that held up the Dreamliner’s 2011 debut by more than three years.

3 Things Successful Innovative Manufacturers are Doing

Reduction in cost and making manufacturing processes more efficient is the one of the top growth strategies of most manufacturing CEOs. This can be seen as change sweeping across the operating model like rearranging the plant layout, strengthening their footprint, adopting advanced manufacturing techniques like 3D printing to robotics.

Innovation in the business model is possibly the biggest challenge that manufacturing CEOs are facing. The fact remains that conventional operating models are undergoing a complete overhaul with agility being at the forefront to capture new market segments and sales channels.

Here are a few areas that sees innovative manufacturers targeting for maximum impact.

-

Race with technology

While most companies plan capital investments over a five-year period, technology continues to evolve at the speed of light. Therefore, the traditional modes of investment and payback, as well as managerial speed needs to be adjusted to sync with the rapid technology evolution. Consumer electronics companies, for example, account for flexibility in adopting new technologies in their product development models.

-

Keeping up with innovation

Innovation is the buzzword for manufacturers today. All too often, it is confined to a lab or small, focused team. Balancing profits from existing line of products versus getting employees to learn new technologies can be a tough situation for manufacturers. Today, innovative companies need to take in the various pros and cons of new technologies and focus on “continuous improvement” techniques.

-

Look long term

While no one can really predict how technology will evolve in the next 10 years, top manufacturers are trying to draw a parallel between their innovation investments and long-term business goals. Manufacturers are choosing investments that will lower operating costs, reduced risk and speed up operational performance for their clients. They are trying to relay their ideas to their employees, suppliers, customers, and shareholders for a 360◦ integration of their innovation investments.