Manufacturing 4

Cornell Study Shows Women Behind on Skill Training

In working-class towns, men find it easy to join the workforce as manual laborers and machinists. Cornell university research shows that the wide pay gap and lack of work pushes women out of blue-collar jobs.

Vocational education schools versus prep courses for college showed a male preference for vocational training, and therefore, a greater likelihood to find better-paid blue-collar jobs upon graduation, shows the Cornell study published in the American Sociological Review.

Touching upon the pay gap for women in blue-collar jobs – it can be as high as 22% less than their male counterparts. This is a significantly wider gap than that in white-collar jobs or service-industry positions shows the same study. The gender gap in employment and wages was more prominently visible in young people from blue-collar communities who completed high school.

In many ways, blue-collar jobs are still just as biased towards men as they were in the 50s. The condition of the female workforce in towns where jobs are mostly concentrated on construction and manufacturing is sharply distinguished from that of women over the U.S. generally, where women have a greater likelihood for going to college than men.

These communities are struggling to fill in the large amount of production jobs that need to be filled. More than 3.5 million vacancies across the U.S. have been estimated over the next 10 years. The present lack of skilled labor could cause a deficit in filling 2 million of those positions, as was predicted by Deloitte and the Manufacturing Institute.

This shows the need for educators to actively address these gender issues in discussions about vocational training while paving the way for college. Today, statistics show a preference for skilled jobs over advanced math. While men can definitely benefit from college prep classes, encouraging women to opt for vocational courses can do much for the economy in the future.

Top Megatrends in Manufacturing

A new era has dawned in the manufacturing industry which is largely driven by digitalization, information technology and customization. These changes can be defined by several megatrends that are sweeping across the manufacturing footprint.

The pros and cons of the Digital Age

Information technology, along with other emerging technologies, are causing a dynamic and continuous change in the ways things get done. For example, smartphones today are miniaturized, have high processing capabilities and are way cheaper than their counterparts from the 60s.

On one hand while this can be a good thing, it also has the power to disrupt whole industries and reshape the workforce like the extinction of weavers and camera film makers.

But new technology and innovation brings with it new processes and advanced business models. For example, 3D printing is enabling the mass production and customization of products by small firms. Other emerging technologies to look out for include nanotechnology.

Big Data and Real-Time Information

The capacity to process large volumes of data for economic purposes has transformed customer care across retail and finance sectors. Big Data also plays a crucial role in manufacturing, with the fast-track incorporation of information technology. This will lead to more accurate forecasting and analysis of plant performance.

Big Data is buoyed by open platforms and crowdsourcing, which enable customer interaction like never before. The design, distribution and service is slated to get a complete overhaul with manufacturers becoming more knowledgeable.

Revolutionizing the workforce

The demographics of the workforce are rapidly changing with 10,000 baby boomers retiring each day. This is a cause of worry among manufacturers who see the institutional knowledge being lost and finding it hard to replace them with millennials who are disinterested in manufacturing jobs. Today, manufacturers are in dire need of a new wave of workforce that is equipped to work on the 21st-century shop floor.

Is This the End of Chinese Manufacturing?

A Chinese financial magazine Caixin Purchasing Managers’ Index along with data complier Markit claimed that trade came in at 48.6 in June, down from 49.2 in May. These numbers seem to spell a stoppage in the flow as global economy deteriorates.

Manufacturers seem to be giving out more pink slips for the third year in a row, Caixin claimed, in a bid to curb costs in the face of a plunging demand. Caixin says that the government must work towards reinforcing its proactive fiscal policy while a prudent monetary policy should continue to be used as a shield against a choppy external economic environment.

With everyone looking to China as one of the key players in global expansion, its economy only grew 6.9% last year, its weakest rate in 25 years. The manufacturing sector seems to be burdened with excess industrial capacity from its prosperous infrastructure-building days.

Growth of Euro-area manufacturing in 2016

In the face of China’s slump, Euro-area manufacturing seems to have taken off. The PMI in Europe rose from 51.5 to 52.8. While these numbers can see a change with the onset of Brexit. Short-term consumer habits may undergo a change with Brexit. The good is though, studies by Eurostat show a rise in employment that is the highest in five years.

Euro-area factory growth was pioneered by Germany and Austria, and expansion was also visible in Spain, Ireland and Italy. Greece also showed signs of growth.

Russia welcomes growth

Russia has seen the greatest growth so far, with its manufacturing industry driven by domestic demand. Russia’s Purchasing Manager’s Index swelled to 51.5 in June from 49.6 in May. This figure has bettered all expert forecasts and is a positive sign for the country’s economy.

3 Things Successful Innovative Manufacturers are Doing

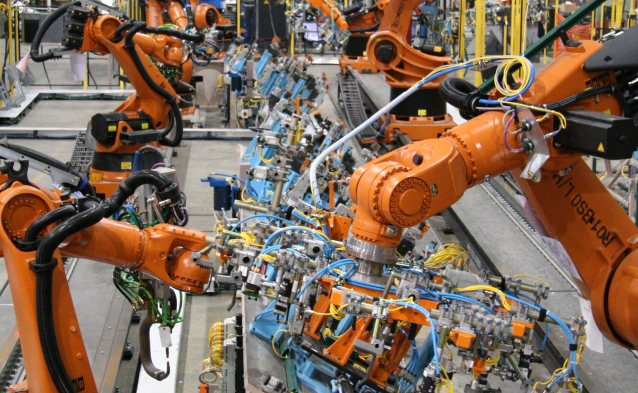

Reduction in cost and making manufacturing processes more efficient is the one of the top growth strategies of most manufacturing CEOs. This can be seen as change sweeping across the operating model like rearranging the plant layout, strengthening their footprint, adopting advanced manufacturing techniques like 3D printing to robotics.

Innovation in the business model is possibly the biggest challenge that manufacturing CEOs are facing. The fact remains that conventional operating models are undergoing a complete overhaul with agility being at the forefront to capture new market segments and sales channels.

Here are a few areas that sees innovative manufacturers targeting for maximum impact.

-

Race with technology

While most companies plan capital investments over a five-year period, technology continues to evolve at the speed of light. Therefore, the traditional modes of investment and payback, as well as managerial speed needs to be adjusted to sync with the rapid technology evolution. Consumer electronics companies, for example, account for flexibility in adopting new technologies in their product development models.

-

Keeping up with innovation

Innovation is the buzzword for manufacturers today. All too often, it is confined to a lab or small, focused team. Balancing profits from existing line of products versus getting employees to learn new technologies can be a tough situation for manufacturers. Today, innovative companies need to take in the various pros and cons of new technologies and focus on “continuous improvement” techniques.

-

Look long term

While no one can really predict how technology will evolve in the next 10 years, top manufacturers are trying to draw a parallel between their innovation investments and long-term business goals. Manufacturers are choosing investments that will lower operating costs, reduced risk and speed up operational performance for their clients. They are trying to relay their ideas to their employees, suppliers, customers, and shareholders for a 360◦ integration of their innovation investments.