Global Economy 3

Is This the End of Chinese Manufacturing?

A Chinese financial magazine Caixin Purchasing Managers’ Index along with data complier Markit claimed that trade came in at 48.6 in June, down from 49.2 in May. These numbers seem to spell a stoppage in the flow as global economy deteriorates.

Manufacturers seem to be giving out more pink slips for the third year in a row, Caixin claimed, in a bid to curb costs in the face of a plunging demand. Caixin says that the government must work towards reinforcing its proactive fiscal policy while a prudent monetary policy should continue to be used as a shield against a choppy external economic environment.

With everyone looking to China as one of the key players in global expansion, its economy only grew 6.9% last year, its weakest rate in 25 years. The manufacturing sector seems to be burdened with excess industrial capacity from its prosperous infrastructure-building days.

Growth of Euro-area manufacturing in 2016

In the face of China’s slump, Euro-area manufacturing seems to have taken off. The PMI in Europe rose from 51.5 to 52.8. While these numbers can see a change with the onset of Brexit. Short-term consumer habits may undergo a change with Brexit. The good is though, studies by Eurostat show a rise in employment that is the highest in five years.

Euro-area factory growth was pioneered by Germany and Austria, and expansion was also visible in Spain, Ireland and Italy. Greece also showed signs of growth.

Russia welcomes growth

Russia has seen the greatest growth so far, with its manufacturing industry driven by domestic demand. Russia’s Purchasing Manager’s Index swelled to 51.5 in June from 49.6 in May. This figure has bettered all expert forecasts and is a positive sign for the country’s economy.

The Lowdown on Foreign Investment in Latin America

America hit a record low last year as Latin American economies saw a downturn for the first time in five years. Foreign investment in the mineral-rich region dropped by 19% reported the UN Economic Commission for Latin America and the Caribbean. This is the lowest figures since 2010.

This is being attributed to the sagging investment in sectors like mining, fossil fuels, etc. and the slowing down of the economy in general, particularly in Brazil. While mining nations like Chile and Peru fell prey to the slowdown, investments in Mexico saw an upsurge specifically in the auto and telecom sectors. On the plus side, these are more likely to prove to be beneficial to the broader economy in terms of technology, education, and indirect job creation.

Brazil has been worst hit, suffering a meltdown for the first time in decades. Its economy has shrunken by 3.8% since last year. News does not seem too good for Chile either, with experts forecasting that the country’s foreign investments would go further downward by 8% by next year.

Due to the sluggish global economy, the entire region is projected to go down by 0.6% this year. While the entire world was speculating of Chinese interest in the Latin American region, real figures are far smaller than the Netherlands (20 percent), the United States (17 percent), and Spain (10 percent). Asian FDI equals a mere 6 percent even with Chinese firms bagging three of the top 20 deals in 2014.

While Latin American countries could definitely do with the finance for transport infrastructure, telecommunications, and electricity, they have to bank on FDI in the face of low regional savings. The substantial foreign owned capital stock has gone up to over $100 billion today. Multinationals usually send home roughly half of these profits, and the rest is put into the local economy. This has become a huge financial burden for countries like Chile, Colombia, and Peru, among others, and possibly devalued their currencies, particularly if the investments don’t put back much in terms of productivity and economic growth.

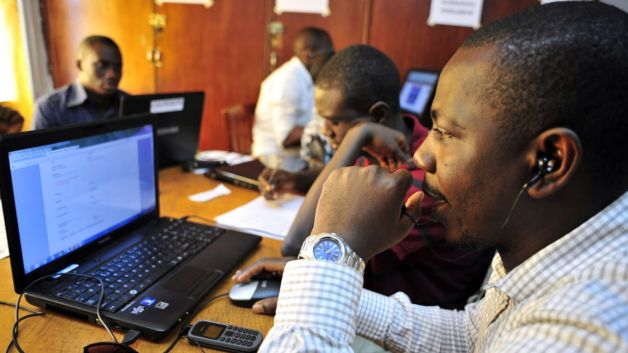

Google to Train 1 Million Africans for Job Readiness

Google Inc. is working on a project to start a series of digital skills training programs in the next year. These programs are aimed at skilling Africans who are suffering due to a slow global economy, with unemployment being rife.

The company is slated to train 300,000 people in South Africa, where the majority of millennials (up to 35%) are unemployed. 600,000 youth from emerging nations like Kenya and Nigeria will be given digital training at no cost, while another 100,000 will be chosen from other sub-Saharan Africa countries.

Google South Africa country head Luke Mckend said, “Google is in Africa for the long haul and we are making an investment in talent. We hope that the people trained will become pioneers in the field and do great things in digital for companies and for Google.”

He also said that this was only the first step in progress and to see Africa conquer the digital world much more needed to be done. He went on to say that the Internet is a great tool for starting new businesses and growing exiting ones, and Google is dedicated to its mission in helping Africa’s emerging markets maximize on the digital revolution.

To accomplish its goal, google has tied up with Livity Africa to create training programs and will soon be setting up an online education website for learners in the African nations. The company is also in talks with several other potential partners across the continent to expand the outreach of the digital skills program and be able to get to even more young learners across Africa.

A TeleGeography Global Internet Geography report has claimed that the internet bandwidth in Africa has gone up 41% between 2014 and 2015. Google has investigated the possibility of Africa having 500 million Internet users by 2020. This is a useful piece of data for the company as it can leverage the Internet users to create a strong workforce for the economy.