Innovation 4

The Good, Bad and Ugly of the IoT

The Internet of Things, shortened as IoT, could possibly be the mascot of the appropriately named Industry 4.0. However, according to high-profile technologists such as Don DeLoach, it could be a double-edged sword.

On serious reflection, the first revolution is a slovenly edition of the current revolution. The Industry 4.0 is a blessing and disaster in equal measure.

The Good

For starters, the IoT is a technological development proposed by the Internet of Things Institute (IoTI). It will enhance our daily activities with Internet connection, facilitating data communications.

First, the Internet of Things bodes well for the latter-day global challenges. How? This includes global warming and strained resources? Over the next two decades, it’s predicted that the global population will increase by 2 billion people. To feed the extra mouths, the farm output has the ability to increase thanks to innovation enabled by the IoT. What’s more, farmers will cash in on better agricultural prospects.

Second, IoT oriented technology has the power to improve global security, enhance healthcare services, and boost the global bread baskets. The Internet of Things has brought about advanced security systems. For instance, the gunfire locator; by using sensors such as acoustic and optical and via geographic information system, this can pinpoint the location of a gunfire incident. These security apparatus can be applied in urban centers to help standby security personnel act and react to such gunfire.

Third, improving care services; the technology breakthrough facilitated by the IoT can be handy in overseeing the welfare of old people and enable medical professionals to get in touch with and distantly liaise with the sick.

FYI, the IoT sector is still in its formative stage. However, it will develop like the way the introduction of smartphones in the market has seen an influx of apps.

The Bad and the Ugly

The Internet of Things Institute has a flip side. The first one is cyber insecurity. There are cyber attacks taking advantage of the loopholes in the IoT. For example, unauthorized people with ill-will can ably get access to government communication platforms and spread propaganda.

Second, a hacker can get unauthorized access to a warehouse containing explosive materials and program them to explode simultaneously. DeLoach opines that this can be catastrophic, especially if terrorists take advantage of the complexity of the Internet of Things.

Third is vulnerability; over the past few years, for example, organizations in the Internet of Things sector confident of their hitherto secure innovations have dared hackers to hack into their systems; the easiness with which the hackers did it questions the security of the systems.

Fourth, lack of privacy; the great quantity of data gathered through the Internet of Things innovations can easily lead to privacy intrusion. Fifth, there is the possibility of business rivalry among the companies providing IoT related services. Lastly, social media platforms can take advantage of the IoT to ignite uprisings.

To sum it up, there’s great unexploited potential in the IoT but stakeholders can be doomed and damned.

Top Megatrends in Manufacturing

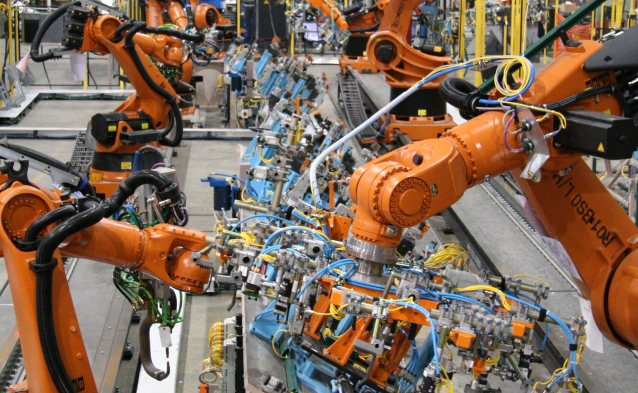

A new era has dawned in the manufacturing industry which is largely driven by digitalization, information technology and customization. These changes can be defined by several megatrends that are sweeping across the manufacturing footprint.

The pros and cons of the Digital Age

Information technology, along with other emerging technologies, are causing a dynamic and continuous change in the ways things get done. For example, smartphones today are miniaturized, have high processing capabilities and are way cheaper than their counterparts from the 60s.

On one hand while this can be a good thing, it also has the power to disrupt whole industries and reshape the workforce like the extinction of weavers and camera film makers.

But new technology and innovation brings with it new processes and advanced business models. For example, 3D printing is enabling the mass production and customization of products by small firms. Other emerging technologies to look out for include nanotechnology.

Big Data and Real-Time Information

The capacity to process large volumes of data for economic purposes has transformed customer care across retail and finance sectors. Big Data also plays a crucial role in manufacturing, with the fast-track incorporation of information technology. This will lead to more accurate forecasting and analysis of plant performance.

Big Data is buoyed by open platforms and crowdsourcing, which enable customer interaction like never before. The design, distribution and service is slated to get a complete overhaul with manufacturers becoming more knowledgeable.

Revolutionizing the workforce

The demographics of the workforce are rapidly changing with 10,000 baby boomers retiring each day. This is a cause of worry among manufacturers who see the institutional knowledge being lost and finding it hard to replace them with millennials who are disinterested in manufacturing jobs. Today, manufacturers are in dire need of a new wave of workforce that is equipped to work on the 21st-century shop floor.

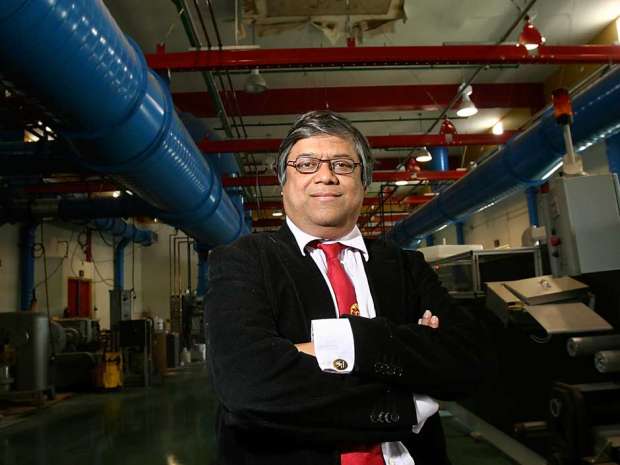

Tiny Canadian Battery Company Could Play David to Goliath Tesla

Tesla Motors Inc., Panasonic Corp. and Samsung Electronics Co. are the giants who are battling it out in the race of mass producing large-scale rechargeable batteries. However, a tiny company may have hit the jackpot: Electrovaya Inc.

This Canadian company primarily manufactures lithium-ion batteries. It is owned and operated by an adjunct professor of electrochemistry at the University of Toronto. While the company’s portfolio might not seem impressive at first glance, investors are lining up at the door with Bloomberg New Energy Finance claiming its valuation at $250 billion by 2040.

Electrovaya’s shares have risen to five times their market value of C$297 million ($228.78 million) over the past 12 months. On the other hand, Tesla’s Powerwall failed to perform and they came down by 20%.

The company has risen at lightning speed, signing several deals worth millions of dollars. Electrovaya’s technology has 400 patents to its name and that is what gives the company its edge claims CEO Sankar Das Gupta. Not only is its flexible ceramic separator highly heat resistant, the company’s production processes are solvent-free which makes them greener for the environment and gives batteries double the life of a conventional one.

Indeed, the CEO claims to want to be the next General Electric. The small firm is taking on goliaths like Panasonic and Tesla, who are involved in joint product development. These two companies are involved in creating a $5 billion lithium-ion gigafactory in Nevada.

To finance their venture, the Canadian company has found some innovative solutions. It bought out Daimler AG’s lithium-ion battery manufacturing plant which was the largest in Europe. However, after the automaker decided to relinquish the business Electrovaya bought it at a fraction of its actual value.

This deal was also of utmost important due to the fact that it consisted of the factory’s proprietary ceramic separator technology. As the bane of a lithium-ion batteries is fire, the company seems to have made a strategic decision at the right time.

CEO Das Gupta claimed that the combination of German and Electrovaya technology will put them way ahead of Panasonic and Samsung. Today, the only competitor he sees is Polypore International Inc.’s lithium-ion separator. This company was acquired by Japan’s Asahi Kasei Corp. for $3.2 billion last year.

Beign a small company, Das Gupta says that the only problems he encounters is working capital. He hopes that the backing of Export Development Canada will help with the guarantee for lenders. While the company is the best bet in the energy equipment today, there’s no saying where the energy-storage marketplace tomorrow.

3 Things Successful Innovative Manufacturers are Doing

Reduction in cost and making manufacturing processes more efficient is the one of the top growth strategies of most manufacturing CEOs. This can be seen as change sweeping across the operating model like rearranging the plant layout, strengthening their footprint, adopting advanced manufacturing techniques like 3D printing to robotics.

Innovation in the business model is possibly the biggest challenge that manufacturing CEOs are facing. The fact remains that conventional operating models are undergoing a complete overhaul with agility being at the forefront to capture new market segments and sales channels.

Here are a few areas that sees innovative manufacturers targeting for maximum impact.

-

Race with technology

While most companies plan capital investments over a five-year period, technology continues to evolve at the speed of light. Therefore, the traditional modes of investment and payback, as well as managerial speed needs to be adjusted to sync with the rapid technology evolution. Consumer electronics companies, for example, account for flexibility in adopting new technologies in their product development models.

-

Keeping up with innovation

Innovation is the buzzword for manufacturers today. All too often, it is confined to a lab or small, focused team. Balancing profits from existing line of products versus getting employees to learn new technologies can be a tough situation for manufacturers. Today, innovative companies need to take in the various pros and cons of new technologies and focus on “continuous improvement” techniques.

-

Look long term

While no one can really predict how technology will evolve in the next 10 years, top manufacturers are trying to draw a parallel between their innovation investments and long-term business goals. Manufacturers are choosing investments that will lower operating costs, reduced risk and speed up operational performance for their clients. They are trying to relay their ideas to their employees, suppliers, customers, and shareholders for a 360◦ integration of their innovation investments.