Supply Chain 4

How Amazon Started the Robotic Arms Race

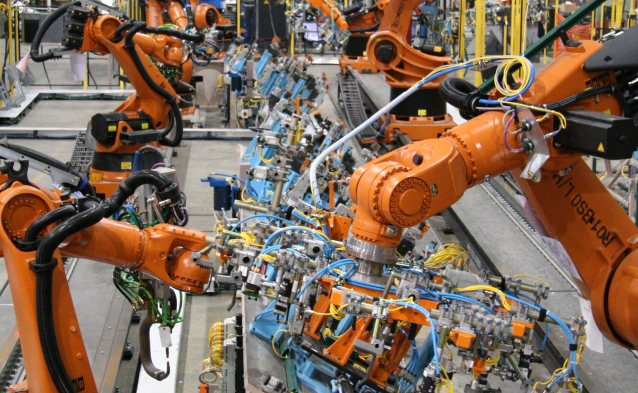

If you were to enter an Amazon warehouse, it is whirlwind of activity. You will come across workers everywhere piling items onto large black and yellow crates. Tall hydraulic arms haul heavy boxes to place them on rafters. What you may also see are a mass of chunky orange robots sliding along the floor, also stacked with boxes brimming with fashion to sports gear.

These are the very well-known Kiva robots, who once were an innovation that promised big things for the automation of inventory management. Amazon purchased their robot armies for w hopping $775 million in 2012. The acquisition elevated Amazon’s CEO Jeff Bezos to the head of an entire industry. He chose to reserve his robotics forces for the sole use of Amazon, effectively stopping Kiva from selling their products to warehouse operators and retailers who used this technology for speedy warehousing and distribution.

Since Kiva was the only player on the market, they were left with no choice. In the present environment, a few startups are gearing up to take off where Kiva left and arm warehouses around the world with new robotics. Amazon’s bots has already proved that robotic technology is indeed a better solution for the supply chain.

However, the new bots that are available look different, this could be attributed to the fact that it is still a nascent industry and partially due to patents. These bots can perform a wide variety of tasks like using mechanical claws to life items off shelves while others have touch screens for automated inventory checks. IAM Robotics’ Swift has been making waves. It is an autonomous mobile picking robot which comes equipped with a 3D item scanner and SwiftLink fleet management software.

Nevertheless, all of these bots are to aimed at fulfilling orders and to get your deliveries to your doorstep easy and quick.

What is the Real Challenge with Omnichannel?

A study conducted by JDA shows that 71% of CEOs consider omnichannel fulfillment to be the future of the consumer goods industry. However, only 19% are able to profitably translate this vision into reality.

Why the supply chain is top priority

Findings have shown that consumers are induced to buy when offered seamless shipping, delivery and returns. These are the key factors that drive the growth strategies of e-commerce ventures. Following these findings, fulfillment has gone to the top of retailers’ lists, with merchants investing in transportation and logistics, delivery options, order management, inventory and returns management.

Regular online shoppers want a turbo-charged supply chain

Free shipping remains the most lurid reason, with nine out of ten shoppers claiming that to be the incentive for shopping online. Over time, this has become the singular most powerful objective for retailers over other logistics concerns, even same-day shipping gained brownie points. One-day shipping (69%) and free returns (68%) are also top persuasive factors for shoppers.

Bringing together in-store and online experiences

While e-commerce is obviously an integral part of our lives, studies show that shopping in brick-and-mortar stores remains a clear preference, though some shoppers showed an openness to a blended shopping experience with physical and online shopping.

Although beacons have had a slow start, there is no mistaking that shoppers might be incentivized to the concept of the in-store experience online, virtual reality e-commerce – or v-commerce.

Sluggish adoption of mobile payments

Privacy and security are the key areas where consumers back off in using mobile payment applications. A greater change in consumer behavior is needed to make mobile payment transactions easier and profitable.

In time, consumer behavior and technology will need to be integrated for a more practical approach to e-retail.

Top Megatrends in Manufacturing

A new era has dawned in the manufacturing industry which is largely driven by digitalization, information technology and customization. These changes can be defined by several megatrends that are sweeping across the manufacturing footprint.

The pros and cons of the Digital Age

Information technology, along with other emerging technologies, are causing a dynamic and continuous change in the ways things get done. For example, smartphones today are miniaturized, have high processing capabilities and are way cheaper than their counterparts from the 60s.

On one hand while this can be a good thing, it also has the power to disrupt whole industries and reshape the workforce like the extinction of weavers and camera film makers.

But new technology and innovation brings with it new processes and advanced business models. For example, 3D printing is enabling the mass production and customization of products by small firms. Other emerging technologies to look out for include nanotechnology.

Big Data and Real-Time Information

The capacity to process large volumes of data for economic purposes has transformed customer care across retail and finance sectors. Big Data also plays a crucial role in manufacturing, with the fast-track incorporation of information technology. This will lead to more accurate forecasting and analysis of plant performance.

Big Data is buoyed by open platforms and crowdsourcing, which enable customer interaction like never before. The design, distribution and service is slated to get a complete overhaul with manufacturers becoming more knowledgeable.

Revolutionizing the workforce

The demographics of the workforce are rapidly changing with 10,000 baby boomers retiring each day. This is a cause of worry among manufacturers who see the institutional knowledge being lost and finding it hard to replace them with millennials who are disinterested in manufacturing jobs. Today, manufacturers are in dire need of a new wave of workforce that is equipped to work on the 21st-century shop floor.

Is This the End of Chinese Manufacturing?

A Chinese financial magazine Caixin Purchasing Managers’ Index along with data complier Markit claimed that trade came in at 48.6 in June, down from 49.2 in May. These numbers seem to spell a stoppage in the flow as global economy deteriorates.

Manufacturers seem to be giving out more pink slips for the third year in a row, Caixin claimed, in a bid to curb costs in the face of a plunging demand. Caixin says that the government must work towards reinforcing its proactive fiscal policy while a prudent monetary policy should continue to be used as a shield against a choppy external economic environment.

With everyone looking to China as one of the key players in global expansion, its economy only grew 6.9% last year, its weakest rate in 25 years. The manufacturing sector seems to be burdened with excess industrial capacity from its prosperous infrastructure-building days.

Growth of Euro-area manufacturing in 2016

In the face of China’s slump, Euro-area manufacturing seems to have taken off. The PMI in Europe rose from 51.5 to 52.8. While these numbers can see a change with the onset of Brexit. Short-term consumer habits may undergo a change with Brexit. The good is though, studies by Eurostat show a rise in employment that is the highest in five years.

Euro-area factory growth was pioneered by Germany and Austria, and expansion was also visible in Spain, Ireland and Italy. Greece also showed signs of growth.

Russia welcomes growth

Russia has seen the greatest growth so far, with its manufacturing industry driven by domestic demand. Russia’s Purchasing Manager’s Index swelled to 51.5 in June from 49.6 in May. This figure has bettered all expert forecasts and is a positive sign for the country’s economy.